Last active

August 29, 2015 14:09

-

-

Save choct155/16a924a5f810f38ee773 to your computer and use it in GitHub Desktop.

Presentation for 2014 National Tax Association Conference

This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

| # Institutional Implications for Revenue Choice: An Analysis of Fiscal Behavior in Colorado | |

| **Presentation for [2014 National Tax Association Conference](http://www.ntanet.org/images/stories/pdf/nta_cot107th2014_web.pdf)** | |

| This talk will be given during the panel scheduled for 1:45 PM on Thursday, November 13th, 2014. It covers preliminary research into the revelation of voter prefereces with respect to [tax and expenditure limitations in Colorado](http://www.colorado.gov/cs/Satellite?blobcol=urldata&blobheader=application%2Fpdf&blobkey=id&blobtable=MungoBlobs&blobwhere=1239165968612&ssbinary=true). Specifically, the research asks whether or not exemption votes (i.e. ["de-Brucing"](http://en.wikipedia.org/wiki/Douglas_Bruce)) can be predicted from 1) [socioeconomic factors](http://censtats.census.gov/usa/usa.shtml) and 2) [ballot initiative components](http://ccionline.org/info-center-library/research-miscellaneous-publications/) (conditional on #1). | |

| ## Session Information | |

| **TOWARD A BETTER UNDERSTANDING OF STATE AND LOCAL PUBLIC FINANCE INSTRUMENTS: EFFICIENCY AND IMPLICATIONS** | |

| **LOCATION:** PERALTA | |

| **Session Chair:** Daniel Mullins, American University | |

| State Retail Sales Tax Collection Gaps: Administrative Impact on Measured C-efficiency - | |

| *John Mikesell, Indiana University* | |

| Consumers’ Share and Producers’ Share of the General Sales Tax - | |

| *Kathryn Birkeland and Raymond Ring, Jr., University of South Dakota* | |

| Institutional Implications for Revenue Choice: An Analysis of Local Fiscal Behavior in Colorado - | |

| *Marvin Ward Jr., Congressional Budget Office* | |

| Local Sales Tax, Cross-Border Shopping, and Distance - | |

| *Iksoo Cho, Nebraska Department of Revenue* | |

| **Discussants:** LeAnn Luna and Donald Bruce, University of Tennessee, | |

| Knoxville |

This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

| --- | |

| title : Institutional Implications for Revenue Choice | |

| subtitle : An Analysis of Fiscal Behavior in Colorado | |

| author : Marvin Ward Jr., Congressional Budget Office | |

| job : Analyst | |

| framework : io2012 # {io2012, html5slides, shower, dzslides, ...} | |

| highlighter : highlight.js # {highlight.js, prettify, highlight} | |

| hitheme : tomorrow # | |

| widgets : [mathjax] # {mathjax, quiz, bootstrap} | |

| mode : selfcontained # {standalone, draft} | |

| --- | |

| <style> | |

| .title-slide { | |

| background-color: #331FA3; | |

| color: #FFFFFF ; | |

| } | |

| .title-slide hgroup > h1{ | |

| background-image: url('https://github.com/choct155/CBO_Talk/blob/master/TEL_intensity_2009.png'); | |

| font-family: 'Oswald', 'Helvetica', sanserif; | |

| color: #FFFFFF ; | |

| } | |

| .title-slide hgroup > h1, | |

| .title-slide hgroup > h2 { | |

| background-image: url('https://github.com/choct155/CBO_Talk/blob/master/TEL_intensity_2009.png'); | |

| color: #FFFFFF ; | |

| } | |

| article p, article li, article li.build, section p, section li{ | |

| font-family: 'Open Sans','Helvetica', 'Crimson Text', 'Garamond', 'Palatino', sans-serif; | |

| text-align: justify; | |

| font-size:22px; | |

| line-height: 1.5em; | |

| color: #444444; | |

| } | |

| slide:not(.segue) h2{ | |

| font-family: 'Calibri', Arial, sans-serif; | |

| font-size: 52px; | |

| font-style: normal; | |

| font-weight: bold; | |

| text-transform: normal; | |

| letter-spacing: -2px; | |

| line-height: 1.2em; | |

| color: #331FA3; | |

| } | |

| </style> | |

| ## The Congressional Budget Office... | |

| ### ... has nothing to with this. | |

| <br> | |

| Any implications, opinions, or findings conveyed in this presentation are the author's, and the author's alone. Not only does CBO not vouch for these findings, they barely condone me talking about them. | |

| <br> | |

| Official Disclaimer: The views expressed in this paper are the author's and should not be interpreted as CBO's. | |

| ==================== | |

| --- | |

| ## Do Tax and Expenditure Limitations Strengthen Fiscal Federalism? | |

| <br> | |

| **Spoiler:** This study does not provide the answer ... but it does explore the foundation. | |

| ========== | |

| <br> | |

| Before knowing whether TELs align the actions of elected officials and voter preferences, it would be helpful to know what voter preferences are. Voter preferences can be partially revealed by understanding "de-Brucing." | |

| 1. Can baseline exemption propensity be predicted via socioeconomic characteristics? | |

| 2. What is the marginal impact of ballot design? | |

| --- &twocol | |

| *** =left | |

| ## What Do TELs Look Like in Colorado? | |

| ### Taxpayer's Bill of Rights (TABOR) | |

| + Voter approval required for tax increases; | |

| + Limit on the annual growth in revenue; | |

| + Creates obstacles for modification of existing limits; and, | |

| + Permits local overrides (i.e. DeBrucing). | |

| ### Gallagher Amendment (GA) | |

| + Holds constant the statewide residential share of property assessment value. | |

| *** =right | |

| ### Statewide Limit on Property Tax Revenue (SLPTR) | |

| + Restricts annual growth in property tax revenue to 5.5%. | |

| <div style='text-align: center;'> | |

| <img width='500' src=https://raw.githubusercontent.com/choct155/CBO_Talk/master/TEL_intensity_2009.png /> | |

| </div> | |

| --- | |

| ## Finances of General Purpose Jurisdictions in Colorado | |

| <div style='text-align: center;'> | |

| <img width='400' src=https://raw.githubusercontent.com/choct155/NTA2014/master/CO_gen_juris_fin.png /> | |

| </div> | |

| --- | |

| ## Do TELs Alter Fiscal Behavior? | |

| + TELs are often passed with the voter assumption that service delivery need not change (Cutler, Elmendorf, Zeckhauser 1997) | |

| + TELs reduce growth in tax revenue (Mullins & Joyce 1996) | |

| + Recent literature increasingly affirms this result (Ballal & Rubenstein 2009) | |

| + TELs increase reliance on miscellaneous revenue sources (Shadbegian 1999) | |

| + TELs increase reliance on state aid (Skidmore 1999) | |

| + TELs exacerbate fiscal stress during recessions (Cutler, Elmendorf, Zeckhauser 1997) | |

| + TELs reduce local spending (Bails & Tieslau 2000) | |

| + TEL constraints are more binding on less affluent communities (Mullins 2004) | |

| --- &twocol | |

| ## Can Exemption Be Predicted with Socioeconomic Indicators? | |

| # Data (1993-2009) | |

| *** =left | |

| ### USA Counties Database | |

| + 521 variables | |

| + Data capture demographics, income, political attitudes, industrial base | |

| + Irregular reporting frequency across variables | |

| *** =right | |

| ### Colorado Counties, Inc. | |

| + Ballot-level indicators (e.g. requested property tax rate increase) | |

| + 527 votes | |

| --- &twocol | |

| ## Can Exemption Be Predicted with Socioeconomic Indicators? | |

| # Approach | |

| *** =left | |

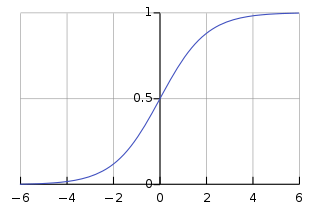

| What's Wrong with Logistic Regression? | |

|  | |

| + Distrbutional Assumptions | |

| + Linear Separating Hyperplane | |

| + Overlapping Groups | |

| *** =right | |

| What are [Support Vector Machines](https://www.youtube.com/watch?v=3liCbRZPrZA)? | |

| <div style='text-align: center;'> | |

| <img width='400' src=http://upload.wikimedia.org/wikipedia/commons/1/1b/Kernel_Machine.png /> | |

| </div> | |

| + High-Dimensional Performance | |

| + Overlap Accommodation | |

| + Post Hoc Processing for Probability | |

| + "Macro"" Processing for Interpretation | |

| --- | |

| ## Can Exemption Be Predicted with Socioeconomic Indicators? | |

| # Performance | |

| Classification Accuracy = 58.3% | |

| Probabilities were recoverable via Platt Scaling. | |

| <div style='text-align: center;'> | |

| <img width='800' src=https://raw.githubusercontent.com/choct155/NTA2014/master/vote_probs.png /> | |

| </div> | |

| --- | |

| ## What Role Does Ballot Design Play? | |

| Operationalizing Ballots | |

| + Revenue Source | |

| + Expenditure Target | |

| + Scope of Change | |

| Additional Variables of Interest | |

| + Propensity to Exempt | |

| + TABOR/SLPTR Constraint | |

| + Gallagher Ratio | |

| --- | |

| ## Results | |

| + There is considerable overlap in the classifier results, but the regression output highlights largely | |

| different aspects. | |

| + Proposals seeking to improve the function of government with commissions or studies | |

| (administrative) adversely impact the likelihood of passage. | |

| + Proposals that do not extend spending authority (no waiver) are statistically significant across | |

| models, but the signs of the effect differ across the classification and regression approaches. | |

| + The same could be said of restricting funding sources to non-property revenues | |

| (ss_nonproperty). | |

| + Open ended spending targets (open) are clear drivers of the classification results, but figure only | |

| modestly in the regression approach. | |

| + Changes to sales tax rates (sales_change) are consistently negative, but lack substantive | |

| significance. The same could be said of public safety (public_safety) and changes to the | |

| property tax rate (prop_change). | |

| --- | |

| ## Questions? | |

| <div style='text-align: center;'> | |

| <img width='200' src=http://www.codeinstitute.net/wp-content/uploads/2014/10/python-logo.png /> | |

| <img width='200' src=http://ipython.org/_images/9_home_fperez_prof_grants_1207-sloan-ipython_proposal_fig_ipython-notebook-specgram.png /> | |

| <img width='200' src=http://scikit-learn.org/stable/_static/scikit-learn-logo-small.png /> | |

| <img width='200' src=http://cran.us.r-project.org/Rlogo.jpg /> | |

| </div> |

This file contains bidirectional Unicode text that may be interpreted or compiled differently than what appears below. To review, open the file in an editor that reveals hidden Unicode characters.

Learn more about bidirectional Unicode characters

| <!DOCTYPE html> | |

| <html> | |

| <head> | |

| <title>Institutional Implications for Revenue Choice</title> | |

| <meta charset="utf-8"> | |

| <meta name="description" content="Institutional Implications for Revenue Choice"> | |

| <meta name="author" content="Marvin Ward Jr., Congressional Budget Office"> | |

| <meta name="generator" content="slidify" /> | |

| <meta name="apple-mobile-web-app-capable" content="yes"> | |

| <meta http-equiv="X-UA-Compatible" content="chrome=1"> | |

| <link rel="stylesheet" href="https://github.com/choct155/NTA2014/blob/master/libraries/frameworks/io2012/css/default.css" media="all" > | |

| <link rel="stylesheet" href="https://github.com/choct155/NTA2014/blob/master/libraries/frameworks/io2012/css/phone.css" | |

| media="only screen and (max-device-width: 480px)" > | |

| <link rel="stylesheet" href="https://github.com/choct155/NTA2014/blob/master/libraries/frameworks/io2012/css/slidify.css" > | |

| <link rel="stylesheet" href="https://github.com/choct155/NTA2014/blob/master/libraries/highlighters/highlight.js/css/tomorrow.css" /> | |

| <base target="_blank"> <!-- This amazingness opens all links in a new tab. --> <link rel=stylesheet href="https://github.com/choct155/NTA2014/blob/master/assets/css/ribbons.css"></link> | |

| <!-- Grab CDN jQuery, fall back to local if offline --> | |

| <script src="http://ajax.aspnetcdn.com/ajax/jQuery/jquery-1.7.min.js"></script> | |

| <script>window.jQuery || document.write('<script src="http://slidifylibraries2.googlecode.com/git/inst/libraries/widgets/quiz/js/jquery.js"><\/script>')</script> | |

| <script data-main="https://github.com/choct155/NTA2014/blob/master/libraries/frameworks/io2012/js/slides.js" | |

| src="https://github.com/choct155/NTA2014/blob/master/libraries/frameworks/io2012/js/require-1.0.8.min.js"> | |

| </script> | |

| </head> | |

| <body style="opacity: 0"> | |

| <slides class="layout-widescreen"> | |

| <!-- LOGO SLIDE --> | |

| <slide class="title-slide segue nobackground"> | |

| <hgroup class="auto-fadein"> | |

| <h1>Institutional Implications for Revenue Choice</h1> | |

| <h2>An Analysis of Fiscal Behavior in Colorado</h2> | |

| <p>Marvin Ward Jr., Congressional Budget Office<br/>Analyst</p> | |

| </hgroup> | |

| <article></article> | |

| </slide> | |

| <!-- SLIDES --> | |

| <slide class="" id="slide-1" style="background:;"> | |

| <article data-timings=""> | |

| <style> | |

| .title-slide { | |

| background-color: #331FA3; | |

| color: #FFFFFF ; | |

| } | |

| .title-slide hgroup > h1{ | |

| background-image: url('https://github.com/choct155/CBO_Talk/blob/master/TEL_intensity_2009.png'); | |

| font-family: 'Oswald', 'Helvetica', sanserif; | |

| color: #FFFFFF ; | |

| } | |

| .title-slide hgroup > h1, | |

| .title-slide hgroup > h2 { | |

| background-image: url('https://github.com/choct155/CBO_Talk/blob/master/TEL_intensity_2009.png'); | |

| color: #FFFFFF ; | |

| } | |

| article p, article li, article li.build, section p, section li{ | |

| font-family: 'Open Sans','Helvetica', 'Crimson Text', 'Garamond', 'Palatino', sans-serif; | |

| text-align: justify; | |

| font-size:22px; | |

| line-height: 1.5em; | |

| color: #444444; | |

| } | |

| slide:not(.segue) h2{ | |

| font-family: 'Calibri', Arial, sans-serif; | |

| font-size: 52px; | |

| font-style: normal; | |

| font-weight: bold; | |

| text-transform: normal; | |

| letter-spacing: -2px; | |

| line-height: 1.2em; | |

| color: #331FA3; | |

| } | |

| </style> | |

| <h2>The Congressional Budget Office...</h2> | |

| <h3>... has nothing to with this.</h3> | |

| <p><br></p> | |

| <p>Any implications, opinions, or findings conveyed in this presentation are the author's, and the author's alone. Not only does CBO not vouch for these findings, they barely condone me talking about them.</p> | |

| <p><br></p> | |

| <h1>Official Disclaimer: The views expressed in this paper are the author's and should not be interpreted as CBO's.</h1> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="" id="slide-2" style="background:;"> | |

| <hgroup> | |

| <h2>Do Tax and Expenditure Limitations Strengthen Fiscal Federalism?</h2> | |

| </hgroup> | |

| <article data-timings=""> | |

| <p><br></p> | |

| <h1><strong>Spoiler:</strong> This study does not provide the answer ... but it does explore the foundation.</h1> | |

| <p><br></p> | |

| <p>Before knowing whether TELs align the actions of elected officials and voter preferences, it would be helpful to know what voter preferences are. Voter preferences can be partially revealed by understanding "de-Brucing."</p> | |

| <ol> | |

| <li>Can baseline exemption propensity be predicted via socioeconomic characteristics?</li> | |

| <li>What is the marginal impact of ballot design?</li> | |

| </ol> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="" id="slide-3" style="background:;"> | |

| <article data-timings=""> | |

| <div style='float:left;width:48%;' class='centered'> | |

| <h2>What Do TELs Look Like in Colorado?</h2> | |

| <h3>Taxpayer's Bill of Rights (TABOR)</h3> | |

| <ul> | |

| <li>Voter approval required for tax increases;</li> | |

| <li>Limit on the annual growth in revenue;</li> | |

| <li>Creates obstacles for modification of existing limits; and,</li> | |

| <li>Permits local overrides (i.e. DeBrucing).</li> | |

| </ul> | |

| <h3>Gallagher Amendment (GA)</h3> | |

| <ul> | |

| <li>Holds constant the statewide residential share of property assessment value.</li> | |

| </ul> | |

| </div> | |

| <div style='float:right;width:48%;'> | |

| <h3>Statewide Limit on Property Tax Revenue (SLPTR)</h3> | |

| <ul> | |

| <li>Restricts annual growth in property tax revenue to 5.5%.</li> | |

| </ul> | |

| <div style='text-align: center;'> | |

| <img width='500' src=https://raw.githubusercontent.com/choct155/CBO_Talk/master/TEL_intensity_2009.png /> | |

| </div> | |

| </div> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="" id="slide-4" style="background:;"> | |

| <hgroup> | |

| <h2>Finances of General Purpose Jurisdictions in Colorado</h2> | |

| </hgroup> | |

| <article data-timings=""> | |

| <div style='text-align: center;'> | |

| <img width='400' src=https://raw.githubusercontent.com/choct155/NTA2014/master/CO_gen_juris_fin.png /> | |

| </div> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="" id="slide-5" style="background:;"> | |

| <hgroup> | |

| <h2>Do TELs Alter Fiscal Behavior?</h2> | |

| </hgroup> | |

| <article data-timings=""> | |

| <ul> | |

| <li>TELs are often passed with the voter assumption that service delivery need not change (Cutler, Elmendorf, Zeckhauser 1997)</li> | |

| <li>TELs reduce growth in tax revenue (Mullins & Joyce 1996)</li> | |

| <li>Recent literature increasingly affirms this result (Ballal & Rubenstein 2009)</li> | |

| <li>TELs increase reliance on miscellaneous revenue sources (Shadbegian 1999)</li> | |

| <li>TELs increase reliance on state aid (Skidmore 1999)</li> | |

| <li>TELs exacerbate fiscal stress during recessions (Cutler, Elmendorf, Zeckhauser 1997)</li> | |

| <li>TELs reduce local spending (Bails & Tieslau 2000)</li> | |

| <li>TEL constraints are more binding on less affluent communities (Mullins 2004)</li> | |

| </ul> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="" id="slide-6" style="background:;"> | |

| <hgroup> | |

| <h2>Can Exemption Be Predicted with Socioeconomic Indicators?</h2> | |

| </hgroup> | |

| <article data-timings=""> | |

| <h1>Data (1993-2009)</h1> | |

| <div style='float:left;width:48%;' class='centered'> | |

| <h3>USA Counties Database</h3> | |

| <ul> | |

| <li>521 variables</li> | |

| <li>Data capture demographics, income, political attitudes, industrial base</li> | |

| <li>Irregular reporting frequency across variables</li> | |

| </ul> | |

| </div> | |

| <div style='float:right;width:48%;'> | |

| <h3>Colorado Counties, Inc.</h3> | |

| <ul> | |

| <li>Ballot-level indicators (e.g. requested property tax rate increase)</li> | |

| <li>527 votes</li> | |

| </ul> | |

| </div> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="" id="slide-7" style="background:;"> | |

| <hgroup> | |

| <h2>Can Exemption Be Predicted with Socioeconomic Indicators?</h2> | |

| </hgroup> | |

| <article data-timings=""> | |

| <h1>Approach</h1> | |

| <div style='float:left;width:48%;' class='centered'> | |

| <p>What's Wrong with Logistic Regression?</p> | |

| <p><img src="http://upload.wikimedia.org/wikipedia/commons/thumb/8/88/Logistic-curve.svg/320px-Logistic-curve.svg.png" alt="'Logistic Function'"></p> | |

| <ul> | |

| <li>Distrbutional Assumptions</li> | |

| <li>Linear Separating Hyperplane</li> | |

| <li>Overlapping Groups</li> | |

| </ul> | |

| </div> | |

| <div style='float:right;width:48%;'> | |

| <p>What are <a href="https://www.youtube.com/watch?v=3liCbRZPrZA">Support Vector Machines</a>?</p> | |

| <div style='text-align: center;'> | |

| <img width='400' src=http://upload.wikimedia.org/wikipedia/commons/1/1b/Kernel_Machine.png /> | |

| </div> | |

| <ul> | |

| <li>High-Dimensional Performance</li> | |

| <li>Overlap Accommodation</li> | |

| <li>Post Hoc Processing for Probability</li> | |

| <li>"Macro"" Processing for Interpretation</li> | |

| </ul> | |

| </div> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="" id="slide-8" style="background:;"> | |

| <hgroup> | |

| <h2>Can Exemption Be Predicted with Socioeconomic Indicators?</h2> | |

| </hgroup> | |

| <article data-timings=""> | |

| <h1>Performance</h1> | |

| <p>Classification Accuracy = 58.3%</p> | |

| <p>Probabilities were recoverable via Platt Scaling.</p> | |

| <div style='text-align: center;'> | |

| <img width='800' src=https://raw.githubusercontent.com/choct155/NTA2014/master/vote_probs.png /> | |

| </div> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="" id="slide-9" style="background:;"> | |

| <hgroup> | |

| <h2>What Role Does Ballot Design Play?</h2> | |

| </hgroup> | |

| <article data-timings=""> | |

| <p>Operationalizing Ballots</p> | |

| <ul> | |

| <li>Revenue Source</li> | |

| <li>Expenditure Target</li> | |

| <li>Scope of Change</li> | |

| </ul> | |

| <p>Additional Variables of Interest</p> | |

| <ul> | |

| <li>Propensity to Exempt</li> | |

| <li>TABOR/SLPTR Constraint</li> | |

| <li>Gallagher Ratio</li> | |

| </ul> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="" id="slide-10" style="background:;"> | |

| <hgroup> | |

| <h2>Results</h2> | |

| </hgroup> | |

| <article data-timings=""> | |

| <ul> | |

| <li><p>There is considerable overlap in the classifier results, but the regression output highlights largely | |

| different aspects.</p></li> | |

| <li><p>Proposals seeking to improve the function of government with commissions or studies | |

| (administrative) adversely impact the likelihood of passage.</p></li> | |

| <li><p>Proposals that do not extend spending authority (no waiver) are statistically significant across | |

| models, but the signs of the effect differ across the classification and regression approaches.</p></li> | |

| <li><p>The same could be said of restricting funding sources to non-property revenues | |

| (ss_nonproperty).</p></li> | |

| <li><p>Open ended spending targets (open) are clear drivers of the classification results, but figure only | |

| modestly in the regression approach.</p></li> | |

| <li><p>Changes to sales tax rates (sales_change) are consistently negative, but lack substantive | |

| significance. The same could be said of public safety (public_safety) and changes to the | |

| property tax rate (prop_change).</p></li> | |

| </ul> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="" id="slide-11" style="background:;"> | |

| <hgroup> | |

| <h2>Questions?</h2> | |

| </hgroup> | |

| <article data-timings=""> | |

| <div style='text-align: center;'> | |

| <img width='400' src=http://www.codeinstitute.net/wp-content/uploads/2014/10/python-logo.png /> | |

| <img width='400' src=http://ipython.org/_images/9_home_fperez_prof_grants_1207-sloan-ipython_proposal_fig_ipython-notebook-specgram.png /> | |

| <img width='400' src=http://scikit-learn.org/stable/_static/scikit-learn-logo-small.png /> | |

| <img width='400' src=http://cran.us.r-project.org/Rlogo.jpg /> | |

| </div> | |

| </article> | |

| <!-- Presenter Notes --> | |

| </slide> | |

| <slide class="backdrop"></slide> | |

| </slides> | |

| <div class="pagination pagination-small" id='io2012-ptoc' style="display:none;"> | |

| <ul> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=1 title=''> | |

| 1 | |

| </a> | |

| </li> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=2 title='Do Tax and Expenditure Limitations Strengthen Fiscal Federalism?'> | |

| 2 | |

| </a> | |

| </li> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=3 title=''> | |

| 3 | |

| </a> | |

| </li> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=4 title='Finances of General Purpose Jurisdictions in Colorado'> | |

| 4 | |

| </a> | |

| </li> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=5 title='Do TELs Alter Fiscal Behavior?'> | |

| 5 | |

| </a> | |

| </li> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=6 title='Can Exemption Be Predicted with Socioeconomic Indicators?'> | |

| 6 | |

| </a> | |

| </li> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=7 title='Can Exemption Be Predicted with Socioeconomic Indicators?'> | |

| 7 | |

| </a> | |

| </li> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=8 title='Can Exemption Be Predicted with Socioeconomic Indicators?'> | |

| 8 | |

| </a> | |

| </li> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=9 title='What Role Does Ballot Design Play?'> | |

| 9 | |

| </a> | |

| </li> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=10 title='Results'> | |

| 10 | |

| </a> | |

| </li> | |

| <li> | |

| <a href="#" target="_self" rel='tooltip' | |

| data-slide=11 title='Questions?'> | |

| 11 | |

| </a> | |

| </li> | |

| </ul> | |

| </div> <!--[if IE]> | |

| <script | |

| src="http://ajax.googleapis.com/ajax/libs/chrome-frame/1/CFInstall.min.js"> | |

| </script> | |

| <script>CFInstall.check({mode: 'overlay'});</script> | |

| <![endif]--> | |

| </body> | |

| <!-- Load Javascripts for Widgets --> | |

| <!-- MathJax: Fall back to local if CDN offline but local image fonts are not supported (saves >100MB) --> | |

| <script type="text/x-mathjax-config"> | |

| MathJax.Hub.Config({ | |

| tex2jax: { | |

| inlineMath: [['$','$'], ['\\(','\\)']], | |

| processEscapes: true | |

| } | |

| }); | |

| </script> | |

| <script type="text/javascript" src="http://cdn.mathjax.org/mathjax/2.0-latest/MathJax.js?config=TeX-AMS-MML_HTMLorMML"></script> | |

| <!-- <script src="https://c328740.ssl.cf1.rackcdn.com/mathjax/2.0-latest/MathJax.js?config=TeX-AMS-MML_HTMLorMML"> | |

| </script> --> | |

| <script>window.MathJax || document.write('<script type="text/x-mathjax-config">MathJax.Hub.Config({"HTML-CSS":{imageFont:null}});<\/script><script src="libraries/widgets/mathjax/MathJax.js?config=TeX-AMS-MML_HTMLorMML"><\/script>') | |

| </script> | |

| <!-- LOAD HIGHLIGHTER JS FILES --> | |

| <script src="libraries/highlighters/highlight.js/highlight.pack.js"></script> | |

| <script>hljs.initHighlightingOnLoad();</script> | |

| <!-- DONE LOADING HIGHLIGHTER JS FILES --> | |

| </html> |

Sign up for free

to join this conversation on GitHub.

Already have an account?

Sign in to comment